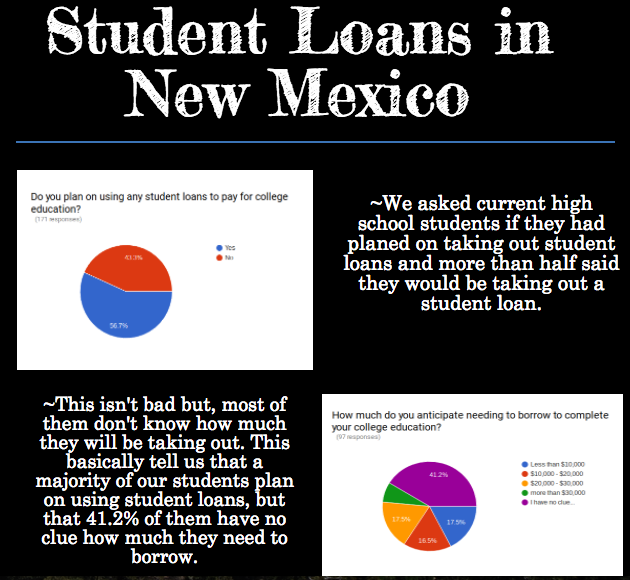

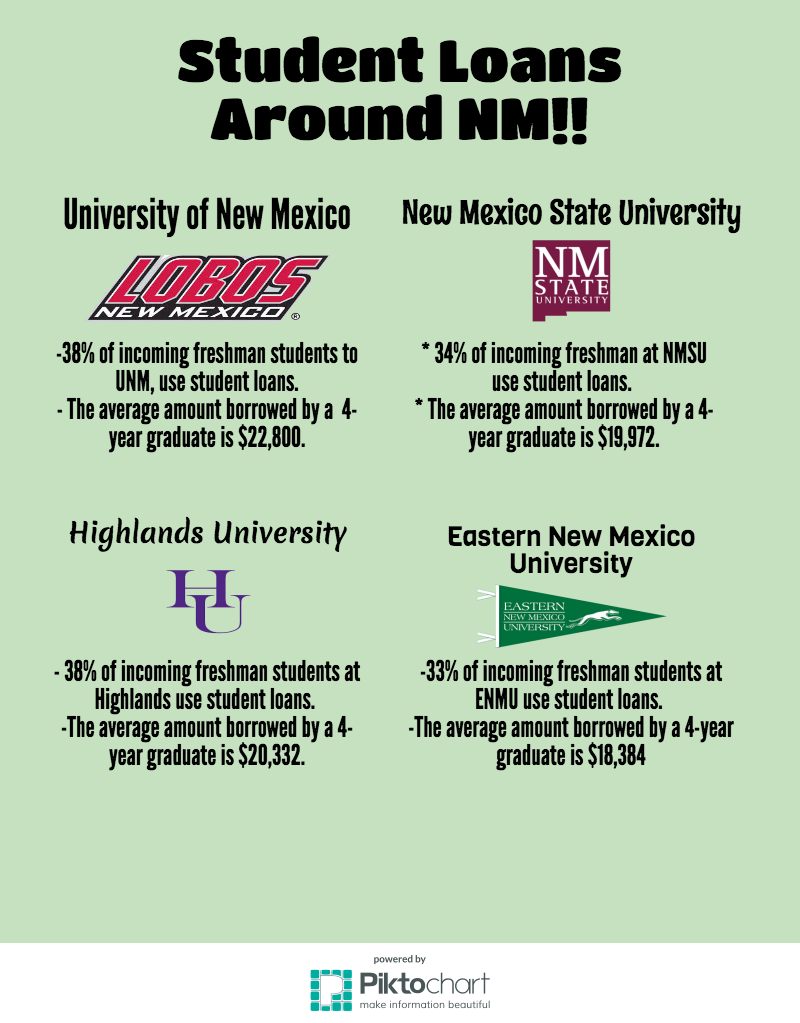

|

Paying for college is a huge expense, and it can be hard to come up with the all of the money to pay for it. Student Loans are a type of loan designed to help students pay for post secondary education and the associated fees, such as tuition, books and supplies, and living expenses. With the help of students loans, you are free to have the flexibility to pay off your college in monthly payments. Four years of college may sound like a long time, but before you know it you’ll be graduated, getting a job, and having to pay off your debt for college.

There are two major categories of student loans; Federal Loans and Private Loans. Federal Loans are offered and guaranteed by the US Government, whereas Private Loans are offered by banks, credit unions or other lending organizations. There are several differences between Federal and Private loans and they are important to know. Federal Loans Federal Loans should be your first source for any borrowing needs you have to go to college. Compared to private loans, Federal Loans offer lower interest rates and more flexibility. First, there are different kinds of Federal Loans that meet the needs of a variety of students and their families:

Other advantages of Federal Loans include that they have fixed interest rates, do not require credit checks since they are guaranteed by the Federal government, and the loans are handled directly by your university, which helps ensure that your tuition and other direct school costs get paid first. Federal Loans are also more flexible and accommodating if you find yourself struggling to repay the loans later. Federal Loans do have some rules and regulations though. The amount you can borrow is limited based on your particular application and financial situation, so if you attend a private or for-profit university with higher tuition and housing costs, your Federal Loans will likely not cover all of your expenses. Private Loans Private Loans should only be considered after all other methods of payment (grants, scholarships, and Federal Loans) have been exercised. Private Loans typically are more expensive and less flexibility than Federal Loans. Since these loans are offered by banks and credit unions, the terms of the loan may vary. However it is important to know that most Private Loans offer variable interest rates (meaning they can change over time) and are typically higher than Federal Loans. They will begin accruing interest immediately and some may even require you begin making payments while still in school. Lastly, private loans are typically less flexible in the event you have difficulty making payments. Also, since there is no backing of the Federal Government, they will require credit checks, and for many students, having a parent or guardian co-sign on the loan. The FAFSA Application The most important aspect you can take when applying for financial aid for private and public universities is to fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA can be filled out online at http://www.fafsa.ed.gov/, or they are accessible through university financial aid offices and high school guidance counselors. It does not matter what college you decide to attend, you must fill out the FAFSA form. Its main purpose is to give colleges an idea of your financial situation, which may decide your eligibility and limits for financial aid. Here is what you will need when filling out this application:

For more information see A Quick Guide to How FAFSA Loans Work. Be a Smart Borrower - Have a Plan Planning for college is complicated and it’s a very important process. Deciding which college to go to, whether you will live on or off campus, choosing a meal plan, how much you will spend on books, and any other living expenses you will encounter are all part of that plan . Bottom line is, you have to find a way to pay for it all. Student Loans are nothing you should take lightly, and you should try to obtain all the free money you can (grants, scholarships, etc). If you’ve planned well and made thoughtful decisions, borrowing money to fund part of your college education is often worth it. But you must always remember that whatever you borrow you will have to pay back. If you are borrowing money, graduation from college should be a non-negotiable goal. The degree you will earn is critical to getting a better job and earning a better income, and having the means to repay your loans. |